Introduction

In an era where digital convenience drives consumer expectations, the healthcare industry is also evolving. The concept of the digital health wallet is gaining traction: a tool that allows patients and providers to manage payments, health data, insurance claims, and provider services—all from a unified, secure digital platform. This article explores why digital health wallets matter, how they are structured, their benefits and challenges, and what the future may hold—especially as it ties into platforms like xrphtoken.com and xrphealthcare.ai that are positioned in the health-tech and fintech convergence.

What Are Digital Health Wallets?

Definition and Core Components

A digital health wallet is a secure, digital platform that allows a patient or insured member to store and manage healthcare-related payment instruments (such as credit/debit cards, bank accounts, insurance data), health records, claims history, and provider interactions—all in one place. (InstaMed)

Key features typically include:

- Payment method storage and fast transaction execution for medical bills, premiums, or provider fees. (InstaMed)

- Integration with health records and claims, enabling users to view bill history, insurance coverage, and access provider networks. (Osplabs)

- Security and identity verification features, such as encryption, authentication, tokenization, and sometimes decentralised identity management. (1Kosmos)

- Interoperability across providers, insurers, pharmacies, and possibly cross-border services. (International Labour Organization)

How It Differs from a Regular Digital Wallet

While many digital wallets (e.g., retail payment apps) focus purely on cashless payments, digital health wallets add layers of healthcare-specific services and integrations: linking to provider networks, insurance claims, health records systems (EHR/EMR), regulatory compliance (HIPAA, GDPR), and health-data interoperability. For example, providers utilising digital-wallet tech can integrate payments into EHR workflows. (TrustCommerce)

Why Digital Health Wallets Matter

For Patients and Consumers

- Speed and convenience. Patients can make payments, view bills, check insurance coverage, and submit claims in real time, with fewer delays. (InstaMed)

- Improved transparency. With payment and claims history in one place, users gain a clearer view of out-of-pocket costs and can compare provider options. (Osplabs)

- Greater control over health data. Some digital health wallets feature identity management and consent-driven data sharing so patients can choose how their data is accessed. (1Kosmos)

For Providers, Insurers, and Healthcare Systems

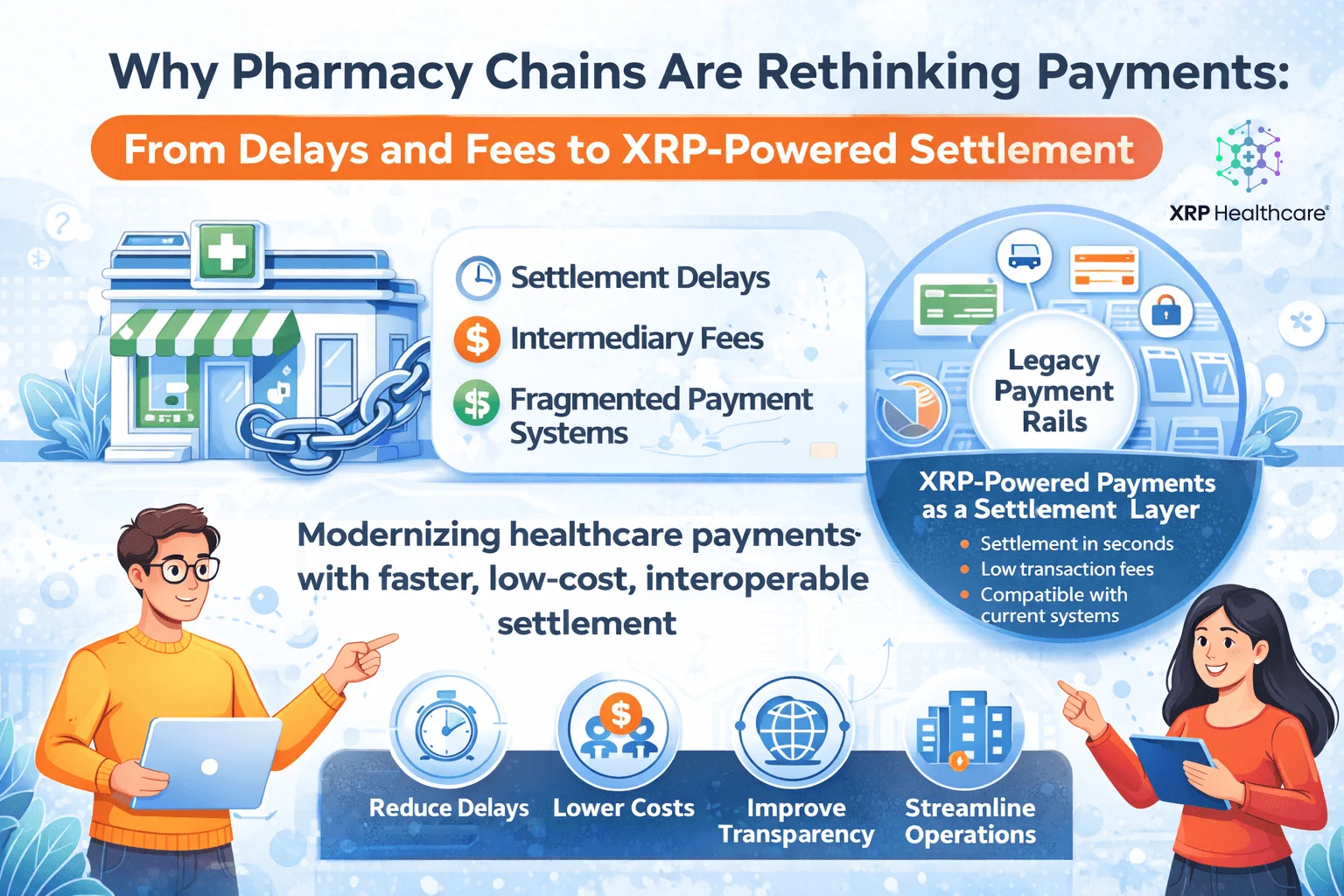

- Operational efficiency and cost savings. Administrative burdens around billing, claims reconciliation, and provider payments can be reduced. (InstaMed)

- Better patient engagement. Using a unified wallet platform can enhance the digital experience for members, leading to higher satisfaction and retention. (InstaMed)

- Interoperability and data integration potential. A health wallet that ties into EHR systems, wearables, pharmacy networks, and insurance data supports a more connected ecosystem. (1Kosmos)

Strategic Importance in Digital Health Financing

Digital technologies for health financing — including tools like digital health wallets — are increasingly recognised by agencies such as the World Health Organization as part of the broader digital health agenda. (World Health Organization)

How Digital Health Wallets Work: Architecture & Transaction Flow

Typical Transaction Flow

- A patient logs into their digital health wallet (mobile app or portal).

- They choose a provider, service, or medication, and the wallet presents relevant insurance coverage or payment options.

- The user authorises payment via stored card/bank/insurance data—often via a tokenised payment method. (Providers integrated with payment terminals and EHR systems can accept contactless or in-app payments.) (TrustCommerce)

- The wallet updates relevant health record/claims modules, marks the transaction in the patient’s history, and may notify the insurer or provider automatically.

- Over time, the wallet accumulates spending data, insurance claims status, provider network access, and possibly wellness incentives.

Key Architectural Components

- Payment integration & tokenisation: Ensures secure storage of payment instruments and quick execution. (TrustCommerce)

- Identity and access management: Ensures that only authorised individuals can access sensitive health and payment data; may leverage biometrics, decentralised identity, and verifiable credentials. (1Kosmos)

- Health record/claims integration: Ties the wallet to EHR/EMR systems, pharmacy/medication networks, and insurance claims databases. (Osplabs)

- Data interoperability standards: For cross-system sharing, such as FHIR (Fast Healthcare Interoperability Resources) or other health data protocols. (PMC)

- Security & compliance layers: Encryption, auditing, consent logs, time-bound access, regulatory alignment (e.g., HIPAA, GDPR). (1Kosmos)

Key Benefits of Digital Health Wallets

Faster and More Secure Transactions

Digital health wallets enable near-instant payments for healthcare services, reducing payment delays and enhancing cash flow for providers. For example, payments can be made in-app or at the point of care via contactless or digital wallet methods.

Reduced Administrative Burden

By integrating payment, claims, data, and provider workflows in a unified platform, paperwork and manual reconciliation efforts decline—leading to cost savings and improved operational efficiency. (InstaMed)

Enhanced Patient Experience & Engagement

Patients expect seamless services akin to retail digital wallets. Offering a familiar digital-wallet experience in healthcare drives engagement, self-service behaviour, and satisfaction. (InstaMed)

Better Data Transparency & Financial Control

Patients and members gain visibility of their health spending, claims status, provider options, and out-of-pocket costs. This transparency supports informed decision-making and cost control. (Osplabs)

Improved Interoperability & Ecosystem Integration

Digital health wallets, if designed with proper standards and identity protocols, can bridge data silos between providers, pharmacies, insurers, and even cross-border care. (1Kosmos)

Challenges & Considerations

Security and Privacy Risks

Handling sensitive health and financial data demands strong security controls. Risks include data breaches, unauthorized access, and identity theft. Systems must include encryption, tokenisation, multi-factor authentication, consent management, and audit logs. (Meegle)

Adoption & Digital Literacy

While younger consumers readily adopt digital wallets, older generations or populations in low-infrastructure settings may be slower to embrace. Infrastructure gaps, awareness, and trust issues remain. (TrustCommerce)

Integration Complexity

Linking payments, provider systems, insurance claims, health records, and identity management across diverse stakeholders is complex. Interoperability standards, legacy system compatibility, and regulatory compliance all pose hurdles. (PMC)

Regulatory and Compliance Issues

Healthcare is highly regulated. Digital solutions must comply with health data regulations (HIPAA in the US, GDPR in the EU, local national laws) and financial transaction regulations. Cross-border use adds further complexity. (1Kosmos)

Equity and Access

Digital health wallets risk exacerbating inequities if certain populations lack access to devices, internet connectivity, or digital literacy. Ensuring inclusive design and alternative pathways remains essential.

The Future of Digital Health Wallets

Emerging Trends

- Decentralised identity and verifiable credentials. Patients may increasingly control their identity and health credentials via self-sovereign identity frameworks, enabling wallet access across providers, insurers, and geographies. (1Kosmos)

- Blockchain and distributed ledger technologies. These may support transparent, immutable transaction logs and consent mechanisms tied into health wallets. Research in blockchain-enabled healthcare shows promise. (arXiv)

- Integration with wellness, wearables, and preventive care. Health wallets may expand beyond payments to include wellness credits, real-time tracking of care, incentives for preventive behaviours, and deeper engagement. (Meegle)

- Global/cross-border health and payments. For medical tourism or international care, multi-currency, cross-border payment, and data exchange may become routine in the health-wallet ecosystem. (International Labour Organization)

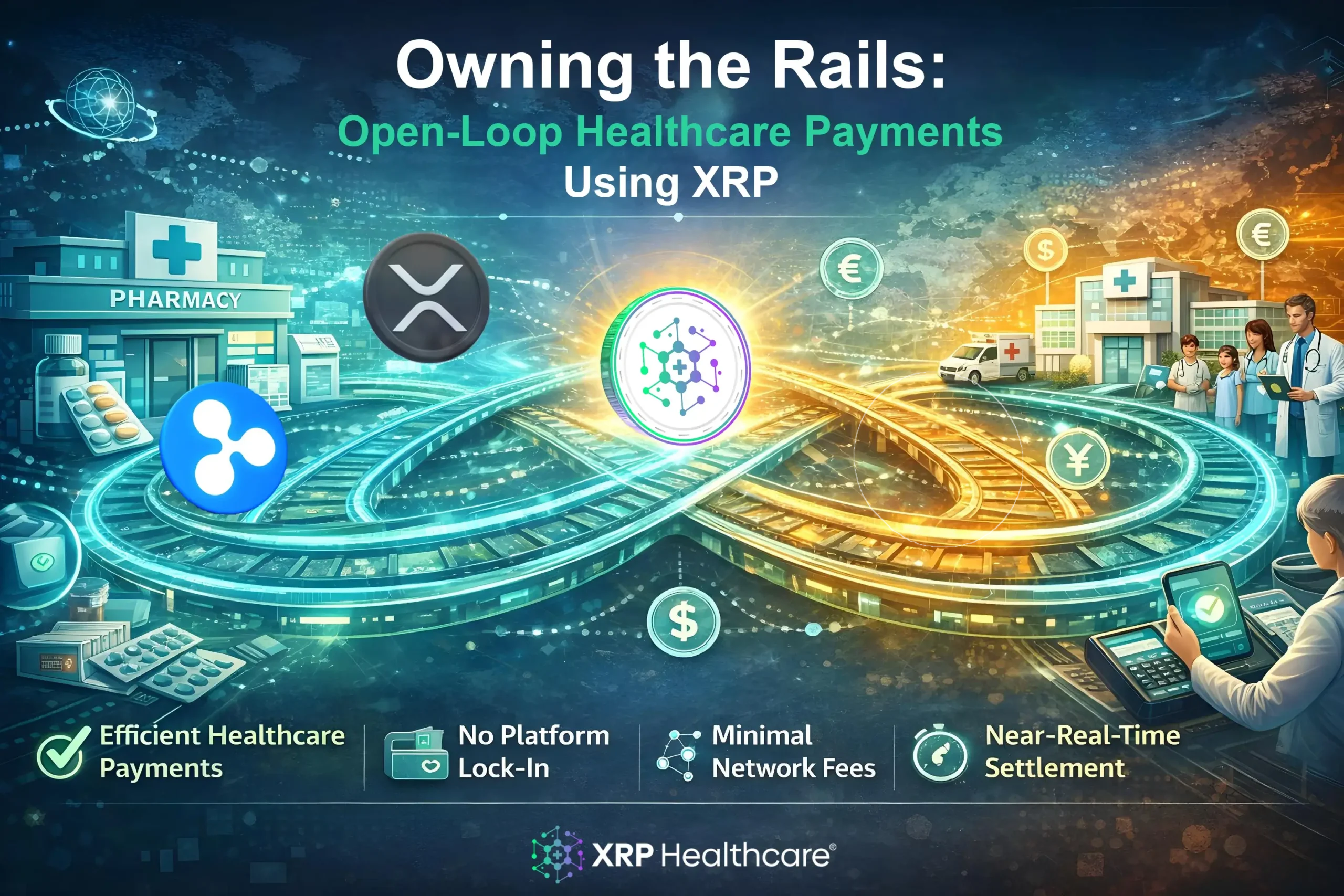

Implications for Platforms like XRPH Token & XRPH-Healthcare AI

Given the presence of platforms such as xrphtoken.com and xrphealthcare.ai, which sit at the intersection of fintech/crypto and healthcare, digital health wallets represent a meaningful frontier. Potential opportunities include:

- Tokenised wallets for health payments and claims settlement.

- Wallets that leverage blockchain or DLT for secure, auditable transactions and identity verification.

- Platforms integrating AI for analytics, predicting patient spending, and routing care, combined with wallet transaction data.

- Enabling a unified health-fintech ecosystem where patients, providers, insurers, and even token-holders interact via digital health wallets.

Best Practices for Implementation

For Healthcare Providers & Insurers

- Choose solutions with strong security architecture (tokenisation, encryption, multi-factor authentication).

- Ensure integration with EHR/EMR systems and provider workflows to minimise friction.

- Provide a user-friendly interface akin to consumer digital wallets to encourage adoption.

- Incorporate transparent cost/claims metadata so patients understand what they are paying for.

- Foster digital literacy and alternative access methods to ensure inclusivity.

For Patients and Consumers

- Use wallets from trusted providers with strong security and reputation.

- Enable multi-factor authentication and monitor transaction history regularly.

- Understand your wallet’s terms, fees, and data-sharing policies.

- Advocate for wallet features that integrate your health data and spending in one place.

- Stay informed about privacy controls and consent mechanisms—especially how your health and payment data may be shared.

Conclusion

Digital health wallets are emerging as a compelling and necessary evolution in healthcare payments and data management. They offer speed, convenience, enhanced security, and deeper transparency—all important in an increasingly digital-first health environment. The integration of payment, claims, records, and provider services into one unified wallet platform helps patients and providers alike.

However, success depends on thoughtful implementation: robust security, interoperability, regulatory compliance, and accessible design. For fintech-health platforms such as XRPH Token and XRPH-Healthcare AI, digital health wallets represent a strategic opportunity to embed value, convenience, and trust in health transactions and services.

As healthcare continues its digital transformation, the digital health wallet may become the central hub for how individuals manage their health finances, data, and care interactions.